Local coffee exporters say the effects of COVID-19 are seriously threatening their viability and as such are seeking help from the Government.

The Jamaica Coffee Exporters Association (JCEA) is lobbying for price support of $170 million to $200 million to enable the sale of non-exportable High Mountain and Blue Mountain Coffee to the local market, replacing imports.

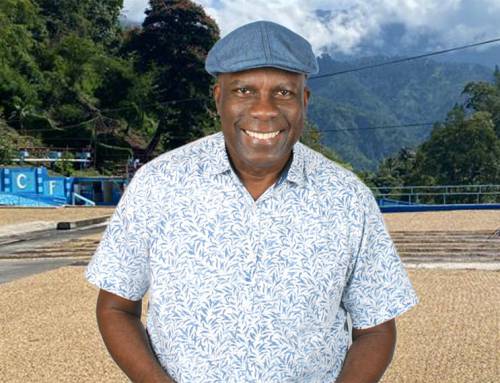

According to JCEA President Norman Grant, the measure is critical to ensuring the survival of more than 5,000 farmers who grow Blue Mountain and High Mountain coffee, and who are now facing reductions in demand and sales in the wake of the COVID-19 pandemic.

He said the JCEA has already commenced discussions with Jamaica Commodity Regulators Association (JACRA) and the Ministry of Industry, Commerce, Agriculture and Fisheries on these issues.

“We are all aware that the coronavirus outbreak has thrown Jamaica, our coffee exporters and companies, and the entire world into uncharted waters,” Grant said in a news release, noting that COVID-19 has had significant impact on the Jamaican coffee industry in the following ways:

- Over 90 per cent reduction in roasted coffee sales, as most hotels have closed and tourist arrivals are at zero;

- Consumption of roasted coffee by locals is down as well, due to decline in restaurant and supermarket business;

- A build-up of inventory of non-exportable Jamaican coffee being held by processors as a result, and:

- There are no new export orders as major markets are also facing economic downturn due to the pandemic, which will negatively influence the demand for the new crop year, 2020-2021.

Grant added that JCEA members are reassessing their operations with an aim to manage and survive the current crisis during and after the COVID-19 pandemic.

“We estimate that the total cherry berry for crop 2019-20 will be 220,000 boxes of Jamaica Blue Mountain and 25,000 boxes of High Mountain Coffee, which reflects a 15 per cent increase in production over the previous crop and [is] a clear sign that coffee production is on a path to recovery,” Grant said.

“So, for us to be importing green bean at this time — due to high inventory as a result of the impact of the COVID-19 pandemic on the tourist and hotel industry, where approximately 30 per cent of the locally grown coffee is consumed or purchased — would be counterproductive,” Grant explained.

He said for the current crop, the JCEA is projecting that the industry will have a green bean export market for 70 per cent of the production primarily in Japan, United States, Europe, and China. But it will have a difficulty selling the 30 per cent non-exportable or local market coffee, due to factors such as the closing of hotels which actually returned coffee supplied to the manufacturing companies before closing.

“This was also compounded by the sinking of the cruise shipping industry, which has significantly affected sales of coffee in gift shops on the north coast, as well as Kingston and the airports, and the slowing of sales in supermarkets across the island,” he argued.

Grant said it is estimated that the reduction could represent approximately 600,000 pounds of coffee at a cost price of US$8 per pound and valued at $700 million, including the cost of cherry berries purchased from farmers and processing fees to bring the coffee to a position for sale (green bean).

He explained that the industry’s inability to sell this coffee would not only result in high losses for the processors of the current crop, but also affect their ability to purchase cherry berry from the farmers for the next crop.

“It is against this background that we are seeking an intervention from the Government to support the sale of this coffee locally, instead of importing coffee from overseas at this time,” Grant said.

He stated that if the industry sells this coffee for US$3 per pound, which is approximately the cost of imported coffee, this would create a loss of US$5 per pound to the processors/farmers.

“We are therefore asking the Government to subsidise this as part of the COVID-19 intervention to the industry, to the tune of US$2 per pound or $170 million, which would be transferred to JACRA to top up the processors on the sale of this coffee,” he stated.

He added that the processors would still be absorbing a loss $250 million, but the approach would reduce the overall loss and allow the purchasing of cherry coffee from the farmers for the balance of this crop, as well as the 2020-21 crop which begins on August 1, 2020.

Jamaica’s Blue Mountain coffee is widely acclaimed as the world’s best coffee, with earnings of up to US$50 million annually at full production, and supporting over 5,000 farmers and more than 102,000 farm families in the rural communities